-

An extremely economical host stated that families should settle their mortgage debts prior to retirement.

-

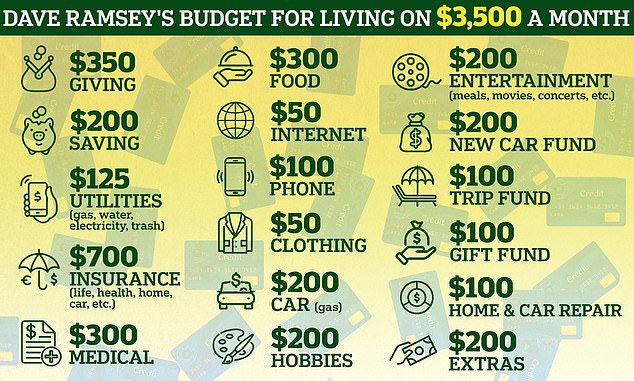

Ramsey provided a practical mock budget for those who retire early to follow.

-

EXPLORE FURTHER: Specialists share the three key strategies for amassing a million dollars through a 401(k).

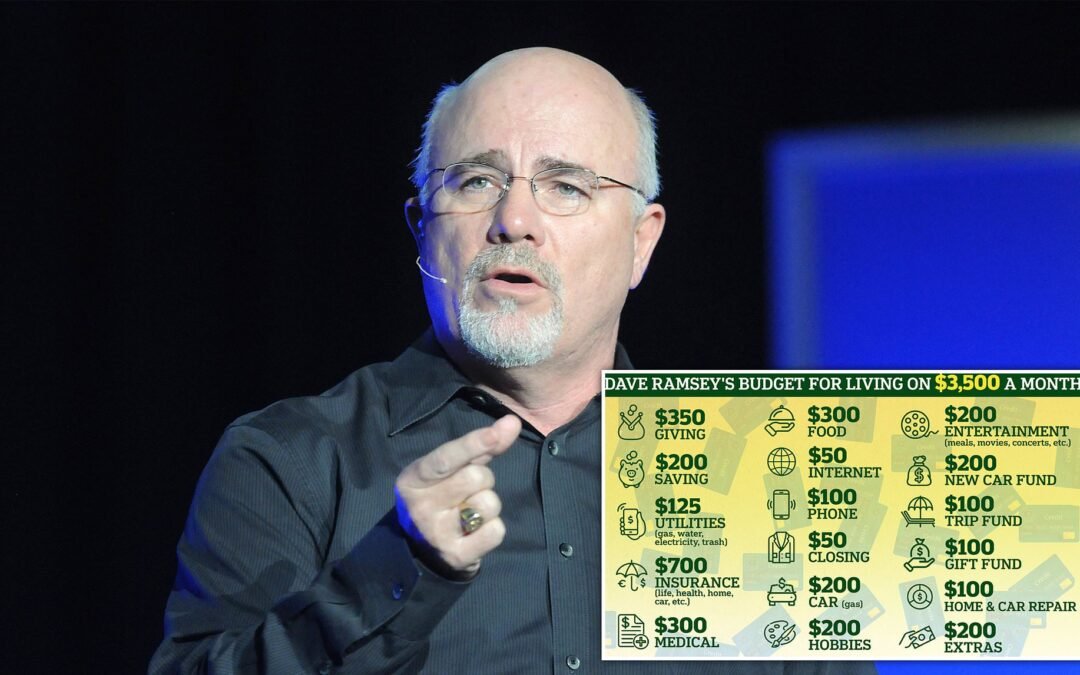

Financial expert Dave Ramsey asserts that the key principle for retiring early is to pay off your home loan.

The contentious radio broadcaster, well-known for his extremely economical advice, encourages families to adopt a nearly debt-free way of life.

In his most recent blog entry, he reaffirms this guidance, detailing his final strategy for retiring from employment prior to reaching 65 years of age.

He emphasizes the importance of settling all debts, particularly mortgages. This is due to the fact that a mortgage usually represents the largest financial obligation most Americans will face throughout their lives and can consume several hundred or even thousand dollars monthly in repayments.

He states that anyone looking forward to retiring early needs to create a simulated retirement budget to account for their expenditures. Additionally, he notes that managing this becomes significantly easier without any debt.

Next, we’ll review Ramsey’s budget plan. This will assist you in determining the annual income required for your retirement years—multiplying this amount by the anticipated duration of your retirement will show you how much you should save overall.

To emphasize his argument, Ramsey refers to an example.

National Study of Millionaires

This highlights that millionaires typically take about 10.2 years to pay off their homes on average.

He states: “Keep in mind that this budget does not account for a mortgage payment. The reason being, your plan is to eliminate the mortgage (along with any other debts) prior to retiring.”

Debt can ruin your dreams of retiring young! It will consume your monthly earnings and deplete your retirement funds quicker than you could utter ‘foreclosure.’

The sample budget provided demonstrates how to manage with a monthly income of $3,500—or an annual amount of $42,000.

A devoted follower of Christianity, Ramsey intends to donate $350 monthly as part of his financial strategy. His budget also encompasses: $200 allocated for savings, $125 set aside for utility bills, $700 designated for various types of insurance, $300 earmarked for healthcare expenses, $400 planned for groceries, $100 reserved for a mobile phone service plan, $50 committed to internet access, $50 intended for clothing purchases, $200 meant for gasoline, and $200 scheduled for leisure activities.

The proposal includes $200 designated for a new vehicle savings account, $100 to boost your travel budget, $100 allocated towards gift purchases, $100 reserved for maintaining homes and vehicles, $200 set aside for leisure activities, and $125 kept as an additional contingency fund.

However, Ramsey warns that your mock budget should also factor in inflation, indicating that sustaining your present budget will differ significantly in the years ahead.

Once you have determined the amount of funds required, the financial expert suggests assessing your present monetary state and settling your outstanding debts.

Ramsey advocates for the ‘debt snowball’ technique, which motivates people to compile a list of their remaining debts and tackle them starting with the smallest balances, irrespective of the interest rates.

Once debts have been settled, he suggests that individuals focus on accumulating enough savings to cover three to six months of living costs in case of emergencies.

Generally speaking, Ramsey advises that families should allocate 14 percent of their earnings towards a tax-favored retirement savings vehicle such as a Roth IRA or 401(k).

He also points out that anyone aiming to retire prematurely should ensure they’re setting aside each additional dollar they can toward their retirement.

He suggests that families should consider opening a brokerage account, as these typically provide greater flexibility compared to conventional retirement accounts. This way, they can make withdrawals at any time without facing penalties.

However, he warns that profits earned from investments in a brokerage account will be subject to capital gains taxes in the same fiscal year they were sold. Additionally, if your account generates dividends, those too will incur taxation, according to Ramsey.

Some of his main suggestions for achieving an early retirement involve: scheduling consistent meetings with a financial planner, adopting significant life adjustments, putting money into property investments, and being strategic after retiring.

Read more